Mobile Card Machines

We are experts in saving your business money on your mobile card machines. At Limrah Payments, we have a fantastic range of mobile terminals. A mobile terminal can be held in the hand and moved around your venue whilst connected to either the WiFi or GPRS. These types of terminals are perfect for hospitality or leisure businesses that need to take payments on the move. The main features are take payment from your clients wherever you are, take Contactless payments, apple Pay and Google Pay as standard, extremely robust and can withstand adverse conditions, accept payments all day off a single charge, pre-installed SIM cards which connects effortlessly with the mobile network.

Portable Card Machines

We are experts in saving your business money on your portable card machines. The portable card machine is perfect for hospitality venues such as bars, restaurants, and pubs. The terminal sits on a holster usually connected by Ethernet and the terminal connects to that through Bluetooth and is removed and taken to a customer to complete a payment, it is then placed back on the base where it continues to charge when not in use. In the modern-day, the portable terminal seems to be replaced by mobile terminals due to the new technology introduced that holds battery life. However, if you need a portable terminal that has a home when it’s not in use then the portable is the one for you.Main features are Take card payments from anywhere in your building, Up to 100, meter range from basestation, Take Contactless payments. Apple Pay and Google Pay as standard, Great for the Hospitality Industry, Outstanding battery life, Compact & lightweight

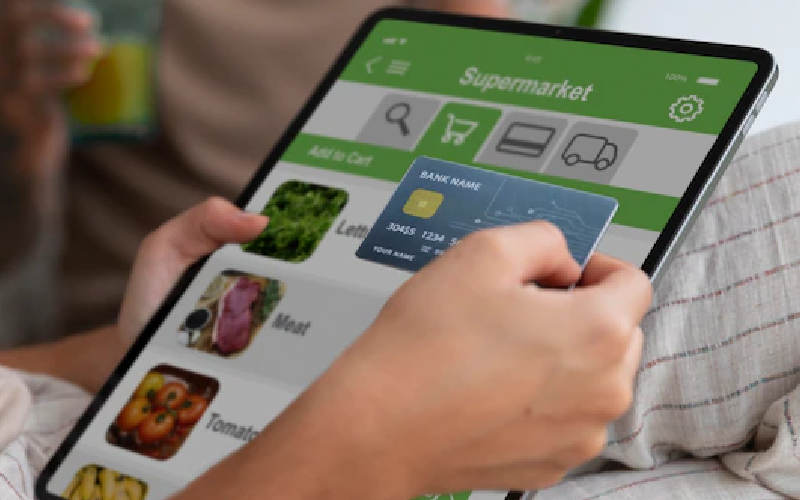

Fixed Card Machines

We are experts in saving your business money on your fixed countertop card machines. A fixed card machine is hard-wired into either your EPOS system or your connection point. You will often find fixed card machines in retail stores or supermarkets on the tills on a pedestal. A hard-wired connection is the most secure of connections however by having it fixed removes any flexibility that you may have with a mobile or portable payment terminal. Features are Plug & play into a phone or broadband line, Take Contactless payments. Apple Pay and, Google Pay as standard, Modestly priced solution for most businesses, Robust & rapid, They are perfect for shops and cafes, Take card payments from the till

E – Commerce Payments

All these businesses need a way to accept payments online. The E-Commerce world is BOOMING now more than ever before, the last few years have forced businesses to take their profile online, it’s also forced consumers to look online first if they need a product or service. With the complex fast-moving world of E-Commerce, Limrah Payments can help you navigate your way through to find the perfect solution for your business. You will need to find a payment gateway that will integrate with your website and shopping cart first, this is usually dictated by the acquirer that you choose to help you take payments on your website. Whether you are looking for a high-risk gateway to accept payments or just a low-risk gateway and are looking to take on innovations such as Apple Pay and Google Pay we can help you.

Virtual Terminal

A Virtual Terminal is a useful tool for businesses that do not need an actual piece of hardware to accept a payment face to face from a consumer. A virtual terminal is a web portal that is behind a secure password that allows businesses to take card details of their customers and to process payments over the phone or with the merchant present. Advantages for your virtual terminal are that you can take a payment from anywhere you have logged in. It’s quick and easy to make a payment and you can even have as many users as you like, making it a cost-effective way to collect payments for your staff. Virtual terminals are usually provided by the acquirer on their platform, although at Limrah Payments our merchant platform has a Virtual terminal built-in as standard. This not only saves the merchant money but makes it very simple for all of our merchants to accept payments via a virtual terminal without the extra costs of rental that would usually occur. Our virtual terminal payment page can be branded as you as the merchant or as our white label payments partner.

Pay By Link

A pay by link is when you send your customer a secure link by either text message or email for them to open securely and pay a balance due in their own time. A pay by link payment is deemed to be a secure payment as the customer is not only entering their own card details but the link has also been sent via their own communication method to an email address or mobile number given by the customer. The pay by link is usually processed through a virtual terminal. However, at Limrah Payments our very own merchant panel supports PBL in our own unique way. Our Merchant panel will allow you to brand your own pay by link page in the colours and brand of your business, making the payment experience tailored to your business. A pay by link is perfect for businesses that need to collect payments from a customer to process orders or to capture additional or timed payments, Takeaways and restaurants utilise the pay by link to capture deposit payments for tables. All in all a pay by link is a fantastic way to ask your clients to pay by card quickly, securely, and efficiently whilst keeping your brand at the forefront of the payments journey.

High Risk Merchant Account

We here at Limrah Payments are specialists on finding you a merchant account for your high-risk business. We have over 15 direct relationships with acquiring banks both in the UK, Europe and Globally that can assist you with your high-risk merchant account. Where others may fail in finding and opening you a merchant account, we have a direct line into underwriting so we can work with them to understand and explain your business and the requirements to get the account open, this approach usually leads to a friendly answer in opening up your high risk merchant account in a timely manner. Our banks range in appetite to risk and we can support your business with acquiring even if you operate in a sector that is traditionally considered to be high risk. With the ever-changing landscape in the SME world at the moment acquiring banks are having to rebalance their business estate and are therefore terminating very good businesses that do not fit the risk profile of the bank. We take great pleasure in helping any business that has been terminated by setting them up with a high-risk merchant account. Please click the button below to register your interest in a high-risk merchant account.

Limrah Payments

CONTACT US